ivari’s claims team is made up of seven highly experienced claims adjudicators who handle all of our life insurance and investment product claims.

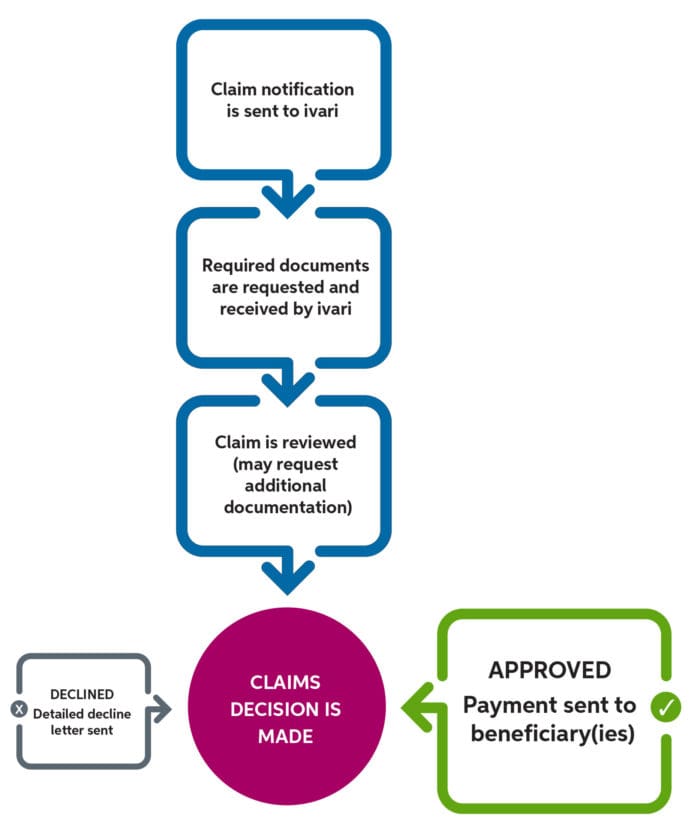

The life insurance claims process

We’re in the business of paying out on the promises we make to our policyholders. In 2024, we paid over 99% of the life claims we received.

- Claim notification sent to ivari – The adjudicator reviews the policy(ies) to confirm the extent of coverage and contacts the individual who reported the claim to provide them with the claim requirements. If the claim occurs within the contestable period, additional documents will be requested.

- Required documents are requested and received by ivari– The adjudicator may, upon review, request additional documents and occasionally engage a third party investigator if more information is needed.

- Claim is reviewed – The adjudicator assesses all the collected information and makes a claims decision.

Our claims brochure explains the different types of claims and the forms required to process them.